- Cashmere School District

- Replacement Levy Information

- Frequently Asked Questions (FAQ)

-

Cashmere School District’s 2024 EP&O Levy FAQs

Q: What is a school levy?

A: A school levy is a local funding measure that helps pay for student-centered programs, services, and staffing that state and federal money doesn’t cover. An easy way to remember what levies pay for is “levies are for learning.” Cashmere’s local levy makes up 14% of Cashmere’s total budget.

Q: Is The February 13 EP&O levy a new tax?

A: No. The Cashmere EP&O Levy on the February 13 ballot is not a new tax. It replaces an existing voter-approved levy to fund the continuation of programs and services families count on. Much like a subscription, every few years the district asks the community to renew this local funding measure and continue to support the following programs and services families expect.

Q: What does the EP&O levy fund, and what’s at stake in the February election?

A: The local levy funds these programs, services, and positions:

- Student safety & security

- Teacher and student support staff salaries

- Music, drama & art

- Athletics

- Textbooks & classroom supplies

- Bus transportation

- Field trips, clubs, and other enrichment activities

- Special education

- Migrant bilingual services

- Preschool; before and after-school programs

- Professional development, and

- District maintenance

Q: Doesn’t the state of Washington fully fund public education?A: No, the state and federal governments do not fully fund public education. Although the state has invested more money in schools in recent years, it only funds part of the actual cost of providing students with a well-rounded education. In Cashmere, the state funds 75% of the school district’s budget, the federal government funds 11%, and local tax dollars support the rest - 14% of Cashmere’s overall operating budget.

Q: The levy amount is increasing slightly but overall local taxes are decreasing?

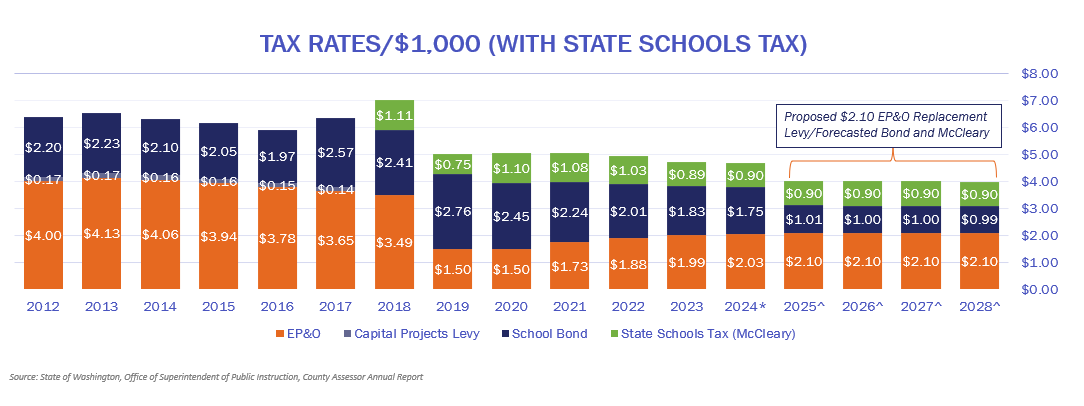

A: Yes. We’re thinking strategically about how to fund the increasing costs of programs and services while minimizing the impact on taxpayers. That’s why we’ve proposed a slight increase to the levy rate when the school bond rate is scheduled to decrease. The result will be lower overall school tax rates in 2025 than residents have seen in the last 10 years. The graph below shows how decreasing bond rates and the proposed replacement EP&O levy would result in lower overall tax rates from 2025 through 2028.

Q: Does the levy fund school staff?

A: Yes, levy funding allows us to maintain current staffing levels for teachers, security officers, health services staff, custodians, and school counselors to support Cashmere kids. In Cashmere School District, the EP&O levy funds:

The EP&O levy alone makes up 14% of the district’s total operating budget.

Q: Does Cashmere School District get extra state funding if the levy passes?

A: Yes, but only if the levy passes. The state gives extra funding called Local Effort Assistance (LEA) to a select few districts that meet certain criteria. Cashmere is considered “property poor” meaning that there are fewer property owners to share the cost of a local levy, so the state will provide assistance. Cashmere is eligible for $1.1 million in LEA from the state, but only if the levy passes.

Q: How much will the EP&O levy cost me?

A: The replacement levy tax rate is estimated to be $2.10 per $1,000 of assessed property value. This is lower than the state maximum rate of $2.50/$1,000.

The owner of a $400,000 home in Cashmere pays about $70/month, or $840/year. The same homeowner is already paying about $67/month, or $802/year, toward the EP&O which expires in December 2024. That means the proposed replacement levy would cost about $38 more per year for the owner of a $400,000 home in Cashmere.

The Cashmere School District bond rate (for building funds) will decrease beginning in 2025 when the proposed levy (for educational programs) would begin. This means that overall tax rates in Cashmere will be lower beginning in 2025. The below graph shows how decreasing school bond rates and the proposed replacement EP&O levy would result in lower overall tax rates beginning in 2025. The orange segments represent continued funding to support school security, teacher salaries, the arts, athletics, and other student-centered programs:

Q: I voted on a school levy measure in 2020. Why is the school levy on the ballot again on February 13, 2024?

A: Much like a subscription, every few years, voters must vote to continue (or renew) funding for local levies. Cashmere typically runs a replacement levy every four years.

You may remember the last time that a Cashmere School District EP&O levy was on the ballot in 2020. Voters passed that levy, and it expires in December 2024. The proposed EP&O levy on the ballot in February 2024 is for funding to replace the current levy, from January 2025 through December 2028.

Q: How does this levy “ask” compare to past levy rates?

A: Even with a proposed seven cent per thousand tax increase total school taxes are much lower than in past years. The current levy proposal will result in lower overall school tax rates in 2025 than residents have seen in the last 10 years.

Q: When and how do I vote?

A: Remember to vote by February 13, 2024. Voters must drop ballots in an official drop box by 8 p.m. on election day, or in a mailbox postmarked by February 13, 2024.

Voter Registration

Monday, February 5 is the deadline to receive new registrations and voter updates online and by mail for the February Special Election. Register to vote online here. Voters may register in person through election day on February 13.

Q: Are tax exemptions available?

A: Yes, for some senior citizens and disabled property owners, tax exemptions may be available. Check with the Chelan County Assessor’s Office for more information: Assessor@co.chelan.wa.us or (509) 667-6365.